Latest News

Deal Announcement

August 19,2025

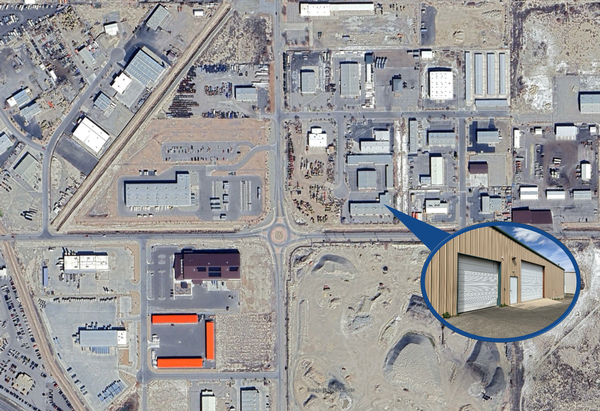

DePaul Real Estate Advisors is pleased to announce the successful sale of a long-term ground lease in Grand Junction, Colorado.

At 702 23 1/10 Road in Grand Junction, the 80-year absolute net ground lease features CPI rent increases every five years. Quality improvements consist of one small bay industrial building with high clearance warehouses. Each of the 4 units has oversize drive-in doors and one unit has dock-high loading. Grand Junction is Colorado’s largest western slope metropolitan area.

Jarod Pate with DePaul Real Estate Advisors represented the seller, a private investor. DePaul coordinated diligence and closed on the property without delays. DePaul would like to thank Scott Dillard with Epique Realty for his professional representation of the buyer.

DePaul Real Estate Advisors is a full service commercial real estate advisory and brokerage firm that specializes in income-producing and investment properties, commercial financing, leasing and site selection.

For more information regarding the services DePaul Real Estate Advisors provide, please contact Paul DeCrescentis or Jarod Pate at 303-333-9799.

Read More...

At 702 23 1/10 Road in Grand Junction, the 80-year absolute net ground lease features CPI rent increases every five years. Quality improvements consist of one small bay industrial building with high clearance warehouses. Each of the 4 units has oversize drive-in doors and one unit has dock-high loading. Grand Junction is Colorado’s largest western slope metropolitan area.

Jarod Pate with DePaul Real Estate Advisors represented the seller, a private investor. DePaul coordinated diligence and closed on the property without delays. DePaul would like to thank Scott Dillard with Epique Realty for his professional representation of the buyer.

DePaul Real Estate Advisors is a full service commercial real estate advisory and brokerage firm that specializes in income-producing and investment properties, commercial financing, leasing and site selection.

For more information regarding the services DePaul Real Estate Advisors provide, please contact Paul DeCrescentis or Jarod Pate at 303-333-9799.

Deal Announcement

June 23, 2025

DePaul Real Estate Advisors is pleased to announce the successful sale of two long-term ground leases in Monument, Colorado and Grand Junction, Colorado.

At 1925 and 1945 Deer Creek Rd. in Monument, the 99-year absolute net ground lease features CPI rent increases every three years. Quality improvements consist of a 36-unit small-bay industrial condominium atop 3.23 acres of land. Monument, Colorado is a fast-growing area north of Colorado Springs with easy access and direct visibility to I-25.

At 708 23 1/10 Road in Grand Junction, the 99-year absolute net ground lease features CPI rent increases every five years. Quality improvements consist of 3 small bay industrial buildings with high clearance warehouses set atop 1.27 acres of land. Grand Junction is Colorado’s largest western slope metropolitan area.

Jarod Pate with DePaul Real Estate Advisors represented the seller, a private investor. A comprehensive marketing strategy generated multiple offers and the buyer was carefully vetted to ensure execution. DePaul coordinated diligence and closed on the properties without delays. DePaul would like to thank John Renfrow of Renfrow Realty for its professional representation of the buyer.

DePaul Real Estate Advisors is a full service commercial real estate advisory and brokerage firm that specializes in income-producing and investment properties, commercial financing, leasing and site selection.

For more information regarding the services DePaul Real Estate Advisors provide, please contact Paul DeCrescentis or Jarod Pate at 303-333-9799.

Read More...

At 1925 and 1945 Deer Creek Rd. in Monument, the 99-year absolute net ground lease features CPI rent increases every three years. Quality improvements consist of a 36-unit small-bay industrial condominium atop 3.23 acres of land. Monument, Colorado is a fast-growing area north of Colorado Springs with easy access and direct visibility to I-25.

At 708 23 1/10 Road in Grand Junction, the 99-year absolute net ground lease features CPI rent increases every five years. Quality improvements consist of 3 small bay industrial buildings with high clearance warehouses set atop 1.27 acres of land. Grand Junction is Colorado’s largest western slope metropolitan area.

Jarod Pate with DePaul Real Estate Advisors represented the seller, a private investor. A comprehensive marketing strategy generated multiple offers and the buyer was carefully vetted to ensure execution. DePaul coordinated diligence and closed on the properties without delays. DePaul would like to thank John Renfrow of Renfrow Realty for its professional representation of the buyer.

DePaul Real Estate Advisors is a full service commercial real estate advisory and brokerage firm that specializes in income-producing and investment properties, commercial financing, leasing and site selection.

For more information regarding the services DePaul Real Estate Advisors provide, please contact Paul DeCrescentis or Jarod Pate at 303-333-9799.

Deal Announcement

June 10, 2025

DePaul Real Estate Advisors is pleased to announce the successful recapitalization of 4900 South College Avenue in Fort Collins, Colorado.

4900 S. College is a multi-tenant commercial building in booming northern Colorado. It features two national credit tenants, VCA Animal Hospitals and AVIS Budget Rental Cars, both on long-term leases. The leases feature NNN expense structure and annual rent increases. The property is ideally positioned in Fort Collins, a vibrant community, and benefits from visibility and direct access to US Highway 287.

DePaul Real Estate Advisors is a full service commercial real estate advisory and brokerage firm that specializes in income-producing and investment properties, commercial financing, leasing and site selection. For more information regarding the services DePaul Real Estate Advisors provide, please contact Paul DeCrescentis or Jarod Pate at 303-333-9799.

Read More...

4900 S. College is a multi-tenant commercial building in booming northern Colorado. It features two national credit tenants, VCA Animal Hospitals and AVIS Budget Rental Cars, both on long-term leases. The leases feature NNN expense structure and annual rent increases. The property is ideally positioned in Fort Collins, a vibrant community, and benefits from visibility and direct access to US Highway 287.

DePaul Real Estate Advisors is a full service commercial real estate advisory and brokerage firm that specializes in income-producing and investment properties, commercial financing, leasing and site selection. For more information regarding the services DePaul Real Estate Advisors provide, please contact Paul DeCrescentis or Jarod Pate at 303-333-9799.

Deal Announcement

October 4, 2022

Single Tenant NNN Investment Opportunity

569 Highway 287, Lafayette, CO

DePaul Real Estate Advisors is pleased to announce the sale of a freestanding, single tenant NNN investment opportunity located in Lafayette, Colorado. Paul DeCrescentis and Jarod Pate at DePaul Real Estate Advisors represented the seller and also handled the lease negotiations on the build-to-suit lease deal with Aspen Dental. The buyer was an out-of-state 1031 exchange. The building sold for $3,100,000, 5.1% cap rate, $886 per square foot.

The dental facility is a newly built 3,500 square foot building on 1.5 acres of land. The tenant, Aspen Dental, has 900 offices in 43 states and is one of the largest and most trusted retail healthcare business support organizations in the U.S.

DePaul Real Estate Advisors is a Denver-based brokerage and investment firm serving investors in commercial real estate and businesses that occupy commercial real estate. DePaul's businesses include asset sales, leasing, arranging senior secured debt, mezzanine debt, preferred equity, and joint venture equity for existing and to-be-built projects. For more information, please contact Paul DeCrescentis at (303)333-9799 or Jarod Pate at (720)881-2727.

Read More...

569 Highway 287, Lafayette, CO

DePaul Real Estate Advisors is pleased to announce the sale of a freestanding, single tenant NNN investment opportunity located in Lafayette, Colorado. Paul DeCrescentis and Jarod Pate at DePaul Real Estate Advisors represented the seller and also handled the lease negotiations on the build-to-suit lease deal with Aspen Dental. The buyer was an out-of-state 1031 exchange. The building sold for $3,100,000, 5.1% cap rate, $886 per square foot.

The dental facility is a newly built 3,500 square foot building on 1.5 acres of land. The tenant, Aspen Dental, has 900 offices in 43 states and is one of the largest and most trusted retail healthcare business support organizations in the U.S.

DePaul Real Estate Advisors is a Denver-based brokerage and investment firm serving investors in commercial real estate and businesses that occupy commercial real estate. DePaul's businesses include asset sales, leasing, arranging senior secured debt, mezzanine debt, preferred equity, and joint venture equity for existing and to-be-built projects. For more information, please contact Paul DeCrescentis at (303)333-9799 or Jarod Pate at (720)881-2727.

Deal Announcement

October 4, 2022

Village Center of Highlands Ranch

9559 S. University Blvd. Highlands Ranch, CO 80126

DePaul Real Estate Advisors is pleased to announce the successful refinancing of Village Center, a grocery shadow-anchored shopping center located in Highlands Ranch, Colorado. Paul DeCrescentis and Jarod Pate at DePaul Real Estate Advisors represented the borrower, an out-of-state family office. Matthew Watson at DePaul also handles the leasing at Village Center, and currently maintains the property at 100% occupancy. The loan was for $7,350,000. The interest rate is 5.05% fixed for 10 years, with interest-only payments.

Village Center is comprised of 28,103 square feet occupied by 15 tenants. The property is located on South University Boulevard, a high-traffic corridor with excellent visibility and access. The shopping center benefits from the bustling grocery anchor, King Soopers, as well as many other surrounding businesses and amenities including Whole Foods, Chuze Fitness, Valor Christian High School, Highlands Ranch High School, which are all within a one-mile radius. The property features strong and stable occupancy since it was built in 1997. Currently, 100% of the center is leased. Tenants include Dependable Cleaners, PediaClinic, T-Mobile, Cornzapoppin, a dental office, Ent, Wing Stop, Dazzling Nails, Orange Theory Fitness, Kung Fu Tea, and Firehouse Subs.

DePaul Real Estate Advisors is a Denver-based brokerage and investment firm serving investors in commercial real estate and businesses that occupy commercial real estate. DePaul's businesses include asset sales, leasing, arranging senior secured debt, mezzanine debt, preferred equity, and joint venture equity for existing and to-be-built projects. For more information, please contact Paul DeCrescentis at (303)333-9799 or Jarod Pate at (720)881-2727.

Deal Announcement

August 10, 2022

Turn-Key Freestanding Medical Center

1300 N. Santa Fe Ave. Pueblo, CO 81003

DePaul Real Estate Advisors is pleased to announce the sale of a turn-key, freestanding medical center located in Pueblo, Colorado. Paul DeCrescentis and Jarod Pate at DePaul Real Estate Advisors represented the seller. The buyer was a local investor, represented by John Grove and Gary Miller of ReMax. The medical center sold for $3.5 million.

The adaptive, state-of-the-art medical facility is an 8,432 square foot building on 1.25 acres of land. The building was designed by HKS Architects and features top-of-the-line materials and finishes. The building is equipped with patient rooms, radiology rooms, a lab, pharmacy, triage bays, and more. It is conveniently located 3 blocks from Parkview Medical Center and directly next to an I-25 interchange.

DePaul Real Estate Advisors is a Denver-based brokerage and investment firm serving investors in commercial real estate and businesses that occupy commercial real estate. DePaul's businesses include asset sales, leasing, arranging senior secured debt, mezzanine debt, preferred equity, and joint venture equity for existing and to-be-built projects. For more information, please contact Paul DeCrescentis at (303)333-9799 or Jarod Pate at (720)881-2727.

Read More...

1300 N. Santa Fe Ave. Pueblo, CO 81003

DePaul Real Estate Advisors is pleased to announce the sale of a turn-key, freestanding medical center located in Pueblo, Colorado. Paul DeCrescentis and Jarod Pate at DePaul Real Estate Advisors represented the seller. The buyer was a local investor, represented by John Grove and Gary Miller of ReMax. The medical center sold for $3.5 million.

The adaptive, state-of-the-art medical facility is an 8,432 square foot building on 1.25 acres of land. The building was designed by HKS Architects and features top-of-the-line materials and finishes. The building is equipped with patient rooms, radiology rooms, a lab, pharmacy, triage bays, and more. It is conveniently located 3 blocks from Parkview Medical Center and directly next to an I-25 interchange.

DePaul Real Estate Advisors is a Denver-based brokerage and investment firm serving investors in commercial real estate and businesses that occupy commercial real estate. DePaul's businesses include asset sales, leasing, arranging senior secured debt, mezzanine debt, preferred equity, and joint venture equity for existing and to-be-built projects. For more information, please contact Paul DeCrescentis at (303)333-9799 or Jarod Pate at (720)881-2727.

Deal Announcement

August 10, 2022

1010 South Interstate 25, Castle Rock, Colorado 80104

DePaul Real Estate Advisors is pleased to announce the sale of 6.46 acres of land located in Castle Rock, Colorado. Jarod Pate at DePaul Real Estate Advisors represented the buyer, an out-of-state investor in a 1031 exchange. The seller is a real estate developer based in Castle Rock, CO. The deal was completed for $2.025 million.

The property is the fee interest in 6.46 acres of land and is subject to a long-term ground lease. The property has frontage on I-25 and is located one and a half miles from an I-25 interchange. It is also located approximately 5 minutes from downtown Castle Rock, a thriving cultural center with many options for shopping, dining, and luxury living.

DePaul Real Estate Advisors is a Denver-based brokerage and investment firm serving investors in commercial real estate and businesses that occupy commercial real estate. DePaul's businesses include asset sales, leasing, arranging senior secured debt, mezzanine debt, preferred equity, and joint venture equity for existing and to-be-built projects. For more information, please contact Paul DeCrescentis at (303)333-9799 or Jarod Pate at (720)881-2727.

Read More...

DePaul Real Estate Advisors is pleased to announce the sale of 6.46 acres of land located in Castle Rock, Colorado. Jarod Pate at DePaul Real Estate Advisors represented the buyer, an out-of-state investor in a 1031 exchange. The seller is a real estate developer based in Castle Rock, CO. The deal was completed for $2.025 million.

The property is the fee interest in 6.46 acres of land and is subject to a long-term ground lease. The property has frontage on I-25 and is located one and a half miles from an I-25 interchange. It is also located approximately 5 minutes from downtown Castle Rock, a thriving cultural center with many options for shopping, dining, and luxury living.

DePaul Real Estate Advisors is a Denver-based brokerage and investment firm serving investors in commercial real estate and businesses that occupy commercial real estate. DePaul's businesses include asset sales, leasing, arranging senior secured debt, mezzanine debt, preferred equity, and joint venture equity for existing and to-be-built projects. For more information, please contact Paul DeCrescentis at (303)333-9799 or Jarod Pate at (720)881-2727.